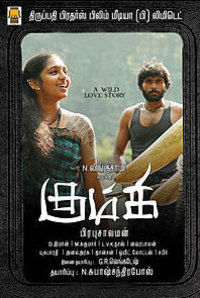

Kumki Tamil Movie

CHEAP CAR INSURANCE Is there anyone that doesn’t want cheap car insurance? Saving money on car insurance is definitely a good thing. In an economy where income has been flat while insurance prices have been rising fast, saving money is good. Like all stories, there’s another side to the cheap car insurance story. What you’ve never been able to know is, “what do you give up when you buy cheap car insurance?” Knowing that giving good products away at a low price isn’t the model by which successful businesses operate, we took a deep dive into what people actually get for the insurance they buy.

In this post we will summarize our deep dive into easy-to-understand info for you. The Problem With Cheap Car Insurance The problem with cheap car insurance is the same problem that exists with all insurance. Due to no transparency in insurance, you don’t know how much protection you’re actually getting. You may now be thinking, “that’s not true, I know exactly how much insurance I have.” After all, you know the limits of your coverage. Unfortunately, coverage limits don’t tell you what you need to know when buying insurance. Even though your policy has a dollar amount of losses that may be covered, you have no way of knowing if the insurance company will be actually pay that amount. Here’s an example.

I had what my company told me was good health insurance. I also had what advertisements tell me was good car insurance. For the car insurance I had a multi-hundred thousand dollar policy. I also had a multi-million dollar umbrella policy.

When I was hit by a car, no insurance company would pay the medical bills. Not my health insurance, not the insurance of the driver that hit me. Not even my own underinsured motorist coverage.

The reality of the dollar amounts on policies is that they do not specify how much a company will pay. Instead, they state the maximum amount an insurance company will ever pay. Coverage limits only limit the insurers liability. Coverage limits do not indicate how much a company will pay. CHEAP CAR INSURANCE QUOTES In Canada, the highest car insurance rates are found in Ontario and, within the province, the most expensive averages reside in Toronto and the greater Toronto area.

One of the best ways to find the lowest prices is through aggressive comparison shopping. With well over 100 companies providing auto insurance in the province though, shopping around can be a full-time job. The quickest and easiest way to find the best options for low-cost auto insurance uses a car insurance calculator. This is an online tool with which a motorist enters personal information, driving history and previous auto insurance claims.

With this information, the calculator generates an estimate for that motorist, making comparisons easy. There are two types of calculator available online.

Some insurance companies offer calculators using their own car insurance products. While this can give an accurate estimate for a car insurance policy from that company, it doesn’t compare with other companies. There’s no way to know how that quote sits in the auto insurance price spectrum. General car insurance calculators compare prices for more than one insurer.

The car insurance calculator available through Ratelab is not only this type of calculator, it is one of the largest and most thorough available to Toronto residents. Partnering with over 50 auto insurance providers across the province, Ratelab’s calculator returns the lowest cost quotes for any car insurance quotes, simply because of the number of companies searched. Imagine the time it would take to search or call 50 companies to appreciate the convenience the Ratelab calculator represents. Average Car Insurance Rates Toronto Quote Date Average Auto Insurance Cost in Toronto. 1-Jan-16 $1,485 1-Jul-16 $1,502 19-Mar-17 $1,553 01-Aug-17 $1,365.Methodology: We used a sample profile for a male driver aged 30 years with his own vehicle having mandatory coverage.

He drives a Honda Civic 2012 car with an average mileage of 5000 – 8000 km per year to commute to work. He has a clean driving record history of 5 years with no accidents or collisions. We surveyed the car insurance prices in the city of Toronto for the purpose of illustrating the range in quotes based on driving record, location, and other criteria. How Much is Car Insurance in Toronto The best rates for this driver, depending on specific postal regions in the city, drop as low as $1,100, while the most expensive regions approach or exceed $2,000. Comparing these to provincial averages, Toronto’s best auto insurance rates approximately match the average rate for the entire province.

The lowest cost areas inside Toronto’s city limits are found in residential areas surrounding the city core, where residents may either not own cars or have cars but use transit for much of their day to day transportation. The most expensive areas for coverage are found in both northeast and northwest corners. These areas are not as conveniently served by transit, and car use becomes more important to get around. The entire city of Toronto, and indeed the GTA as well, suffers from typical big city pressures that drive up car insurance rates. High population density means more traffic, greater risk for collisions and a higher likelihood of car theft and vandalism. Each of these factors drive up insurance premiums and spread costs to each insured driver in the city. Benefits of Using a Car Insurance Calculator in Toronto, Canada When used correctly, car insurance calculators are quite accurate.

Using one will give you peace of mind, knowing that you’re getting a good deal. It’s also great to use if you need to check your current policy against competitors to make sure you can’t save money by switching. Calculators can also provide recommendations on deductibles and limits based on your answers, making them a helpful guide for choosing coverage. Most Popular Car Brands in Toronto The most popular car insured in Toronto is the Honda Civic LX 4 door. Overall, residents in Toronto favour these five car brands: Honda, Toyota, Mazda, Nissan, and Ford. When you are driving on the Don Valley Parkway or the Danforth, there is a good chance you will see a large number of these vehicles cruising down the highway because one thing heavy commuters know is to buy a car from a brand you can trust.

Who Shops for Car Insurance in Toronto? Toronto residents are among the most diverse in the country, with millions of people behind the wheel each day.

The average resident in the Toronto area who shops for car insurance is between 35 and 36 years of age. Further analysis reveals that 71.4% of drivers shopping for car insurance Toronto are males, and 28.6-% are females. Toronto drivers have a surprisingly low rate of accidents and tickets, given the millions of motorists on the road and long commutes in heavy traffic. Out of all of the insured drivers in Toronto, 9.8% of male drivers and 8.07% of female drivers have received a ticket or been involved in a motor vehicle accident in the past.

Annually, 9.1% of male motorists and 9.9% of female drivers report receiving a ticket. Each year, about 9.5% of females and 7.5% of males report an accident. How Toronto Car Insurance Companies Calculate Premiums The provincial government of Ontario sets many rules about how insurance premiums are supposed to be calculated, but individual insurance companies have some room to adjust their rates. Within a reasonable limit, your premium should reflect the likelihood of you submitting a claim to the insurance company.

The drivers who are labeled lower risk are thought to have a lower chance of submitting a claim, so they pay less in premiums than drivers who are considered more likely to need expenses covered. When determining your risk factor, there are several things the insurance company looks at, including your driving history, the type of car you drive and where you live.

Just because you haven’t submitted a claim in the past doesn’t mean you’ll necessarily have super cheap car insurance Toronto. By analyzing a range of factors, insurance companies sort their customers into demographic groups. Each group has a different risk factor and corresponding premium level. How Your Insurance Premiums are Spent. If you’re wondering what the insurance company does with your money, you may be interested in a simple breakdown of where your insurance dollars go.

For each dollar of a premium, roughly half goes back to policy-holders in the form of paid out claims. Another 15 cents goes to taxes and local communities while 20 cents goes to operating and regulatory costs and roughly 10 cents goes toward profit. These numbers fluctuate slightly between insurance companies. The property and casualty insurance industry landscape frequently changes as companies purchase, merge and re-brand. All types of insurance are represented by brokers, agents who handle policies through several different insurance companies. Prior to the advent of online car insurance calculators, a broker was often the best bet for comparison shopping auto policies. Even today, a broker is a strong ally once a motorist identifies the best rates and providers while using a car insurance calculator.

In Toronto and the GTA, some brokers recognized in their industry as leading performers include:. ones DesLauriers Insurance. Nacora Insurance Brokers Ltd. Jardine Lloyd Thompson Canada. Mitchell Sandham Financial Services.

Kumki Tamil Movie Free Download

The Insurance Market. KRG Insurance Brokers.

Highcourt Partners Ltd. RIO Insurance Brokers. Broker Team Insurance. Tredd Insurance Brokers (Source: ) How to Reduce Car Insurance Toronto There are ways to combat high Toronto car insurance costs, even in the pricey Toronto market. Every car on Ontario roads must carry basic insurance. This coverage principally ensures that other people remain protected in an accident with an at-fault driver.

That driver – and their vehicle – are not particularly well covered by basic policies. The Ontario government only requires $200,000 of third party liability protection in the minimum mandatory policy. In the case of a serious accident, settlements can easily exceed this amount. It’s common for drivers to opt for greater coverage of $500,000, $1 million or even $2 million in third-party liability insurance. More coverage equals higher premiums. Adjusting collision and comprehensive deductibles is the most common way to save. The lowest deductible amount in Ontario is $300 for each type of additional coverage.

This means that if a car is damaged or stolen, the driver pays $300 in most cases before the insurance company contributes. The $300 level is the most expensive in terms of monthly premiums.

Many drivers will choose $500, $1,500 or even greater deductibles in return for lower policy rates. CHEAP CAR INSURANCE Is there anyone that doesn’t want cheap car insurance? Saving money on car insurance is definitely a good thing.

In an economy where income has been flat while insurance prices have been rising fast, saving money is good. Like all stories, there’s another side to the cheap car insurance story. What you’ve never been able to know is, “what do you give up when you buy cheap car insurance?” Knowing that giving good products away at a low price isn’t the model by which successful businesses operate, we took a deep dive into what people actually get for the insurance they buy. In this post we will summarize our deep dive into easy-to-understand info for you. The Problem With Cheap Car Insurance The problem with cheap car insurance is the same problem that exists with all insurance.

Due to no transparency in insurance, you don’t know how much protection you’re actually getting. You may now be thinking, “that’s not true, I know exactly how much insurance I have.” After all, you know the limits of your coverage.

Unfortunately, coverage limits don’t tell you what you need to know when buying insurance. Even though your policy has a dollar amount of losses that may be covered, you have no way of knowing if the insurance company will be actually pay that amount. Here’s an example. I had what my company told me was good health insurance. I also had what advertisements tell me was good car insurance.

For the car insurance I had a multi-hundred thousand dollar policy. I also had a multi-million dollar umbrella policy. When I was hit by a car, no insurance company would pay the medical bills. Not my health insurance, not the insurance of the driver that hit me.

Not even my own underinsured motorist coverage. The reality of the dollar amounts on policies is that they do not specify how much a company will pay. Instead, they state the maximum amount an insurance company will ever pay. Coverage limits only limit the insurers liability. Coverage limits do not indicate how much a company will pay.